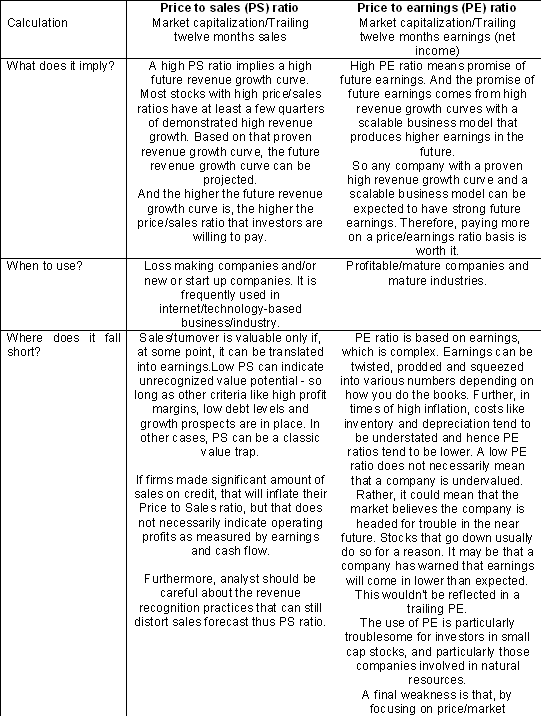

Market participants frequently talks about Price earnings ratio famously referred as “PE ratio”. However, there are times when Price to sales ratio known as “PS ratio” becomes more important and relevant. Sometimes market is willing to focus on earnings (PE ratio) and other times sales (PS ratio) becomes more important. Here are some key differences between these two ratios/terminologies:

Stock broker should know the difference between PE & PS

Now, readers should have good understanding of these ratios and when to use them. However, readers should understand that without comparing the PE or PS of a company with, say, its history, its sector or the market as a whole, the ratios could be misinterpreted or rendered utterly meaningless.

Also Read : Use Fundamental Analysis to Select Right Stocks

Pay Lowest Brokerage Now Start Trading With Us

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

[…] of the most commonly used valuation ratio is the price-to-earnings (P/E) ratio. P/E ratio compares a stock’s prevalent market price with its earnings per share. This indicates how much an […]

[…] de las relaciones de valoración más utilizadas es la relación precio-beneficio (P/E). Relación P / E compara el precio de mercado predominante de una acción con sus ganancias por acción. Esto indica […]

[…] of the most commonly used valuation ratio is the price-to-earnings (P/E) ratio. P/E ratio compares a stock’s prevalent market price with its earnings per share. This indicates how […]

[…] Price to earnings vs Price to sales – Understand the difference between PE and PS ratio and also know how PE and PS are calculated. To know more click here at TradeSmart. […]

[…] Also Read : Price to sales ratio Vs. Price earnings ratio […]