When we were in school, we were conveniently taught that the sun rises in the east and sets in the west. Little did anyone in the class ever objected, although we were also taught in the geography class again, that the sun is the centre of the universe and all planets, including our beloved Earth also revolves around the sun. So then, how come the sun rises and sets, when it is actually static. Well, no one bothered, coz everyone just wanted to pass the exams and move on.

Such is the tragedy of life. No one bothers even knowing that what is being given out to them is thrash. Everyone just wants to move to the next level without much ado.

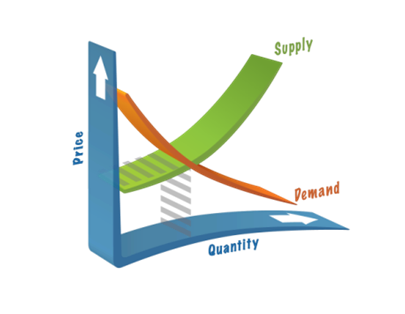

How demand & supply is interlinked in share market

Then we jump into college and what blissful days.. aahhh… the canteen, the lovely cheerful and every -enthusiastic life, filled with non-stop nonsense and chaos somewhere or the other… and then the Economics class. So we heard, “When the demand goes up, the price comes down. And when price goes up, demand falls. Supply comes down when price goes falls, Demand goes up, when supply comes down”. So net-net, Demand and Supply are inversely correlated in share market. Price is a function of Demand. So on and so forth. Mugged it well, passed the exams. Didn’t try to comprehend the real life scenarios.

Back to the Futures

Five years in the future, and we are on the desk now, trading and managing investment portfolios at some of the best known broking firms in the country. The Notice on the Cabin reads out loud, “Buy when market falls, Sell when market rises”. Ok. Point noted.

Suddenly it’s not just school and college, where we can just do whatever has been told. “BUY WHEN MARKETS FALL”. But when to buy, the market can keep on sinking, so how does one decide at what levels to gain entry? What will be the turnaround price level?

onlineLets try our Economic Funda

Ok. Let’s try our Economics funda here and work out. The market price for Company XYZ should be directly linked to the demand for the shares in the market for Company XYZ. Cool. So when the demand goes up, the buying opportunity will come in. Gazing at trading apps the market terminals, we try to look at clues on the demand for XYZ shares. Suddenly, there is a big news, that XYZ has decided to get into a new collaboration with the government for a new project. That’s it!! There is a sudden demand to buy the shares. Everyone wants to have a piece of XYZ shares now. But hang on.. Why is the price moving up? The demand is growing and so is the price. Didn’t these people learn in college, that Demand and price are inversely related. Hello, everyone, the price has to come down. But the prices of the shares on the exchanges are just leaping up crazily. Up and Up and Up.. and suddenly the price remains constant for a few minutes. Tonnes of shares traded on the exchange. And the price becomes flat. Demand still exists, but the price is constant. And like one of the bollywood movies, the anti climax begins, the price starts falling down. Demand is still in. People are still buying online through trading apps. Price keeps on inching down. Demand still continues. Price goes down and down. And then comes back to almost the same point, where it was before the news came out.

So what about those Economists who wrote those demand-supply-price equations?

Didn’t they ever trade on the stock markets to understand, that Economics does not work in the stock markets. Trading is a gaming area, where there is no rule. Either you buy or you sell.

The Rule of the Game is Simple

There is no such thing as equilibrium price. There is no consistency. There is no such things as stock markets being down or markets rising. You can only know the stock market was down, when you see it going up. You decide on when you want to enter. And once you make the entry, just hold on and pray, that the price moves up. (unless ofcourse, you are one of those, what make the stock market J)

Likewise when you sell. The rule of the game is simpler said, than done. Once you come of a stock, don’t even bother to look at the price. If it falls, you will be happy, but if the price goes higher and higher, you would only end up sulking.

Make your money and move on!!!

Open Lowest Brokerage Trading Account Now

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]