Welcome to the fourth edition of our weekly musings.

Volatility is back in global markets and may continue to dampen the investor sentiment as many underlying factors are expected to affect the world, including India. Back home, the rise in geopolitical tensions between India and China, weak economic indicators, stagflation fears with a rise in inflation, and the growing number of covid-19 cases have kept investors and traders on the edge. On the global front, the upcoming US Presidential elections, oil prices, and the fear of the second wave of Covid-19 led pandemic could affect the sentiments.

The high-frequency indicators such as E-way bill generations, automobile registrations, unemployment rate, bank credit growth, air traffic, and export figures show a mixed outlook for India’s economy going forward. While E-way bills generated in September have reached the pre-Covid levels, the bank credit growth is yet to pick up. Although the unemployment figures have dipped, the primary factor behind this drop is the fall in rural unemployment as the urban unemployment continues to witness a marginal rise.

RBI’s MPC fails to contain the inflation; What to expect?

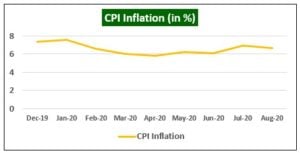

With the monetary policy committee of RBI set to get 3 new external members in its policy review meet on October 1st, they will be facing a major challenge of meeting the inflation targeting framework set up with an agreement between the government and the RBI. While the current MPC has been successful in keeping the inflation rates between the target zones of 2-6%, for most of its time, somewhere it came at the cost of economic growth and finally failed to sustain between the range at the end.

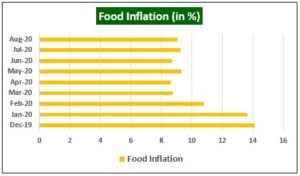

A stringent lockdown was enforced at the end of March, which led to demand depression and the expectation was such that monetary policy will be left with a lot of space to act upon as lower demand for goods generally tends to put lower price pressure. However, supply-chain disruptions as a result of local lockdowns led to a rise in cost for manufacturers which eventually pushed up the prices. Apart from the higher core inflation due to supply-chain disruptions, elevated food inflation on the backdrop of failed crop harvests due to a delayed monsoon in 2019, and price pressures on other food items such as fish, cereals, and oil, etc. was also one of the reasons for the rise in inflation.

Source: News Reports, Tavaga Research

CPI inflation for August came in at 6.7% which means that, except April, inflation in India has remained above the upper band of the inflation target zone of 6% over the last 9 months. (Source: Bloomberg Quint)

Source: News Reports, Tavaga Research

With good monsoons in the last 3 months, food inflation is expected to ease off in the coming months which may bring down the inflation well below the current levels. However, with a sharp pickup in economic activity expected in the first 2 quarters of FY21 leading to higher import prices, domestic inflation could fail to sustain below the 6% levels over the long term. Another factor that might contribute to a rise in headline inflation is the increase in crude oil prices to $50-60 per barrel as the demand for petroleum products improves once normalcy returns.

Public sector lenders resort to fundraising as uncertainty looms

In order to strengthen the balance sheets and fuel credit growth, some public sector banks have chosen to emulate the private lenders in raising funds to beat the adverse impact caused by covid-19. Most of the public sector banks have relied on government infusion as a result of limited private interest.

However, the board of Central Bank of India on 22nd September approved the bank’s plan to raise about Rs 5000 crore through a qualified institutional placement at a discount of 6%. This comes at a time when India ratings and Research, has said that the requirement of fresh capital to public sector banks remains within the range of 35,000-55,000 crore to meet the Tier-1 ratio of 10%. Apart from the Central Bank of India, 5 other PSBs have either raised fresh equity capital or received necessary approvals from respective boards to raise capital.

Below is the list of PSU banks who have received approval from their boards to raise equity capital:

|

Name of the Bank |

Amount (in INR crores) |

|

State Bank of India |

20,000 |

|

Central Bank of India |

5,000 |

|

Canara Bank |

5,000 |

|

Bank of Baroda |

9,000 |

|

Punjab National Bank |

7,000 |

|

Bank of India |

8,000 |

Source: Bloomberg Quint, Tavaga Research

For withstanding the fears caused by the pandemic, the banks are expected to raise capital not only to meet the capital adequacy ratio but to go beyond the minimum capital requirements this time.

Capital Adequacy Ratio of PSU Banks

|

Name of the Bank |

Capital Adequacy Ratio (in %) |

|

Canara Bank |

14 |

|

Bank of Baroda |

13 |

|

Punjab National Bank |

14 |

|

Jammu Kashmir Bank |

11.40 |

|

Central Bank |

12 |

|

State Bank of India |

13 |

Source: moneycontrol.com, Tavaga Research

More credit guarantees, fiscal stimulus, money supply as US votes

As the US gets ready to vote on November 3rd 2020, stalled negotiations on the additional economic support bill are back on the table as house speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin have agreed to sit together to restart formal talks amidst weak economic news and increasing pressure from moderates in her (Pelosi’s) caucus.

The House of Representatives led by the Democrats are preparing a new coronavirus stimulus relief package that could include direct transfer of $1200 for American adults and $500 for dependents. Apart from direct payments; unemployment benefits, loans, rental assistance, and aids to airlines are also on the radar like the previous stimulus package which might go for a vote in the House on 2nd October but with a narrower version. The Democratic-backed Heroes Act (the first economic support bill) had a price tag of $3.4 trillion, however, this version of stimulus is expected to be worth $2.4 trillion.

While the economic outlook of most countries remains clouded, the news of additional stimulus package helped to ease off the fears not only in the US markets but also in Asian markets as India, Japan, South Korea, and Indonesia ended on a green note on Friday. A weak economy is an ideal situation for global equities where the sovereign governments are trying to stimulate by either providing direct transfer of cash or by providing cheaper loans and moratoriums.

Coming up in the Week:

- Government’s borrowing plan to be announced by the RBI on 30th September

- China September Manufacturing PMI on 30th September

- RBI Policy Review meet on 1st October

- India’s September Manufacturing PMI to be announced on 1st October

Happy Investing!

Tavaga Advisory Services is the official partner for providing advisory services to TradeSmart clients

Tavaga & Trade Smart has issued this report for information purposes only. This is not an investment document.

Please refer to https://tavaga.com/terms.html for disclosures.