Since the 1990s India has moved to electronic trading in stock markets. A person willing to trade in stock markets needs to have a trading account and demat account. A trading account is a way to do buy and sell transactions in stocks. On the other hand, a demat account is used to store stocks bought by a person. Brokerage firms like TradeSmart Online provide facility to open online demat account. For example, if you buy 100 shares of SBI at 10 am in the morning and sell it before market closing on the same day, you would need a trading account to do that. In case, you plan to hold those shares in your account, these 100 shares will be stored in your demat account. The transaction to buy is done through the trading account but the shares are stored in your demat account.

Differentiate stock market trading & demat account by experience

Each trading account comes with a trading ID which is used by the exchanges to identify every transaction.

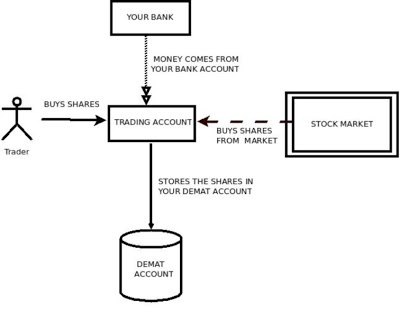

The above image explains how the whole transaction works for a stock market investor. You transfer money from your bank account to a trading account which is provided by your broker. The transaction with the exchanges happens in this account. You buy shares from the market. After the settlement period, the security is moved and stored in your demat account. When you sell the shares, the shares are removed from your demat account and transferred into the counterparty demat who now owns the shares.

Also Read: Trading Types

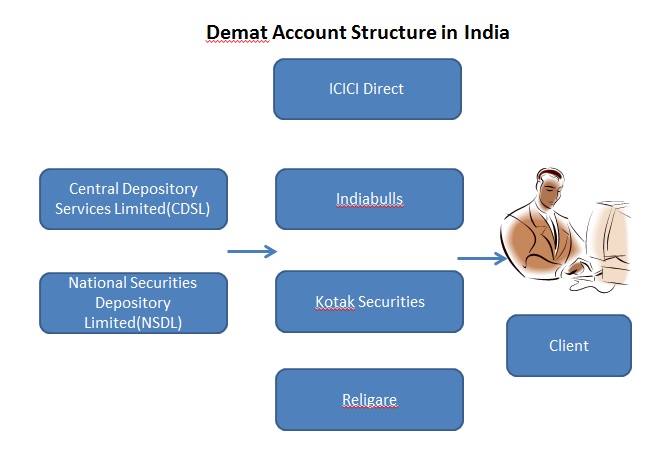

The above image explains how the stock broker – depository network works in India. CDSL and NSDL are depository institutions in India with which your demat accounts are opened. They maintain the records of all demat accounts and monitor the ownership of publicly listed shares of individuals. Each trader or investor in Indian stock market can cross check his or her ownership through his demat account held in these institutions. When you do a transaction with your stock broker, the back end of the brokerage firms will transfer the shares to your demat account. In this way, transparency is maintained at every level. An individual cannot be cheated by the stock broker in this way since the individual has direct access to his or her trading and demat account. Individuals should be careful that all shares are accounted for in demat account as some brokers use shares of their clients for margining and earn extra income from such activities.

Open Lowest Brokerage

Demat & Trading Account Now

Also Read: Trading lessons from day-to-day games

The trading account is held with the share broker. The margins and additional cash is held in the trading account and is with the share broker. I hope the article clarifies the basics of share investing. Happy investing!

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

Hi Shahsandy,

Glad to now you liked the post.

Great post to Understand the Difference. For trading in share market you need complete knowledge of this 2 accounts. Bdw thanks for sharing such information. Keep Posting.

You need to have a Demat Account to hold your offers in an electronic configuration. Furthermore, to trade stock markets, you require a trading account. Both are unmistakable, however, critical parts of the exchanging interaction.

[…] Also Read: Difference between Stock Market Trading and Demat Account […]

Great post on the various stock market trading and demat account. Thanks for sharing.

[…] This is one of the essentials for anyone to start investing in share market in India. Open a Demat Account and trading account, you need to have one if you wish to invest or trade in […]