Welcome to the 7th edition of our weekly musings!

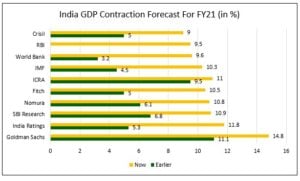

In the musings published last week, we discussed the minutes of the RBI monetary policy committee’s first policy meet after the constitution of 3 new external members and the central bank’s projection of India’s GDP for FY21. While the RBI forecasted India to contract 9.5% in FY2020-21, the projections of IMF were on similar lines albeit more severe, as the lender expects India’s GDP to decline by 10.3% in FY2020-21.

The improvement in high-frequency indicators continues with no negative surprises as optimism abounds with a sustained reduction in new Covid-19 cases and the pace of economic recovery. Over the seven-day period ending October 14, electricity consumption was 7% higher when compared to a similar period in 2019. While there was a sequential decline in freight volume in October, on a year-on-year basis, the railway freight volume is much higher. The daily average of new property registrations in the Indian state of Maharashtra is considerably higher when compared to the daily average registrations of March 2020. Cars, goods carriers, and two-wheeler registrations, too, were sequentially up for the data available up to September 2020.

FM Nirmala Sitharaman announces a stimulus to boost demand; What to expect?

India’s finance minister, on October 12, 2020, introduced more measures to boost consumer demand ahead of the festive season to the extent of Rs 73,000 crores.

- The government employees will be allowed to utilize their tax-exempt travel allowances and spend them on goods and services. These allowances are a part payment of wages of federal employees of the government in advance

- The infrastructure sector gets a boost as the government is set to increase its investments in building ports, roads, and new defense projects by a whopping Rs 25,000 crore

- An interest-free 50-year loan worth Rs 12,000 crore to states for spending on capital projects

With Covid-19 cases still on the rise, the Indian government has been holding back on direct spending as the major focus is still tilting towards tackling the spread of the virus. The government deems fit to announce more measures once the virus cases subside.

What can we expect from future relief packages?

- A downward revision in the GST rate in the auto sector, solely for 2-wheelers as the category doesn’t fall under the ambit of luxury goods

- Special fiscal packages to the sectors that have been hit the most during a pandemic, mainly – aviation, tourism, and hotel-hospitality

- Pundits are expecting a higher direct expenditure compared to the Atmanirbhar package in the next set of reliefs to be announced. Relief is expected for India’s non-salaried middle class through an urban jobs scheme, simultaneously focusing on rural employment and direct cash transfers to farmers, and the needy

While the Indian government has announced relief packages of more than 20 lakh crores, most of it has been to do with liquidity in the form of credit guarantees and other lending support. With low levels of overall demand and consumption still persisting, there is room for monetary easing by the RBI as well once the inflationary spike eases.

As the festive season arrives in India, the further relief packages will focus on boosting consumer confidence with the timing and mode of stimulus playing a crucial role.

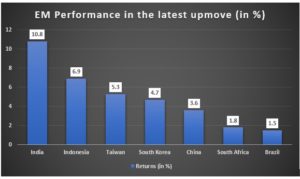

India Outperforms its peers; Benchmark Nifty races ahead of the MSCI Emerging Market index

With global equity markets witnessing an uptick on the backdrop of optimism around the US stimulus, the domestic markets, too, have rallied sharply. Since the lows of September 24th, 2020, the benchmark Nifty has rallied almost 11%. While the Nifty has gained 11%, the MSCI Emerging Market (EM) Index has managed to rise only by 7.4%. Benchmark indices of China, Taiwan, and South Korea, the top three weights on the MSCI EM index, have rallied between 3.5-5.5% respectively.

Emerging Markets Performance in the latest upmove

Source: Bloomberg, Business Standard, Tavaga Research

More and more measures being rolled out by the finance ministry to stimulate the consumer demand along with making available cheaper loans to state governments have been the primary factors for markets to scale highs. Although the recent rally has enabled the domestic markets to bring down the gap (to 3%) between the Nifty and MSCI EM index on a YTD (Year-To-Date) basis, India still lags its EM peers by 7.5-8% on the basis of 1-year performance.

YTD Performance of Nifty 50 and MSCI EM Index

Source: Google Finance, Tavaga Research

The IMF recently projected India’s GDP to decline by -10.3% in FY21 in its IMF-World Economic Outlook report. The multilateral lending organization also expects India to be the worst hit after Sri Lanka among South Asian nations, due to the Covid-19 pandemic.

India GDP Forecast for FY21

Source: Business Standard, Tavaga Research

With such projections, it will be tough for India’s domestic indices to continue outperforming its EM peers. Along with a weak economic outlook by most rating agencies, sustaining this outperformance could be difficult as there is no room left for improvement in valuations in the short term as earnings continue to remain under pressure.

However, with robust pre-festive season sales in India, expectations of more relief packages to sectors, firm global cues, and a decline in new Covid-19 cases, the positives affecting the domestic equity markets outweigh the negatives and thus, the benchmark indices Nifty and Sensex are expected to continue recovering from the September sell-off.

India’s expert panel on Covid-19 comprising of scientists from IITs, IISc Bangalore, ISI Kolkata, and CMC Vellore, have pointed out that new coronavirus cases peaked in mid-September and the containment of active cases can be achieved by February 2021, thereby signaling a relief.

Moreover, the agriculture sector which has relatively remained unharmed due to the Covid-19 pandemic that brought the global economy to a standstill could race ahead in terms of growth when compared to other sectors of the economy. With normal monsoons and higher output, the sector can enable India to go into a positive trajectory with respect to GDP growth in the 4th quarter of FY21.

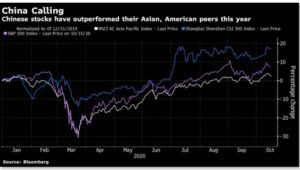

Gold and Asian Stocks in focus to Hedge Presidential Election Outcome

Asian money managers are buying a range of traditional products and deploying unconventional strategies as the US presidential election campaign gets heated up.

Funds are piled into Chinese and other Asian equities, the yen, and gold as Asian assets might have a limited impact on the outcome of election results in the long run. This also comes on the backdrop of outperformance of the Chinese equity markets and the MSCI Asia Pacific Index against the S&P 500.

Chinese Stocks Have Outperformed the MSCI Asia Pacific Index and the S&P 500

Source: Bloomberg, Tavaga Research

Even as Joe Biden, the Democratic Presidential candidate widens his lead in the run-up to the November 3rd showdown, a survey by the Bank of America shows how the global fund managers are bracing for extreme market volatility as they expect the election outcomes to be contested.

Coming Up in the Week:

- China Q3 GDP Growth Data – 19th October

- India Bank Loan growth – 23rd October

- Top companies to report earnings – ACC, Britannia, Hindustan Unilever, Ultratech Cement, Bajaj Finserv, Asian Paints, Tech Mahindra, Nestle, etc.

Happy Investing!