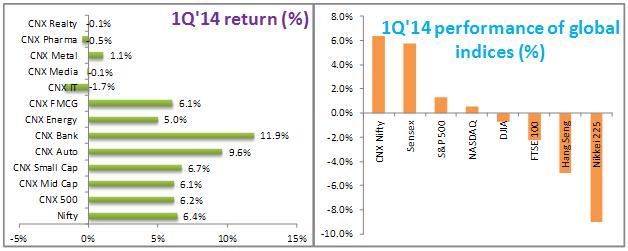

The Indian equity market was on clear uptrend in March’14 with major indices scaling new high almost every passing day. Small and midcap stocks were also seen in action which was missing recently. Uptrend in the equity market was primarily on account of stronger and stronger FII inflows which crossed USD3.2bn in March’14. Expectation of a decisive verdict in upcoming general election fuelled the uptrend. Market is now expecting that the India will get a new government which will implement economic reforms. Robust FII inflows also helped INR to close below 60 against USD. India outperformed most of the global indices in 1Q’14.

Chart 1: 1Q’14 Performance

Source: NSE; Yahoo Finance

Source: NSE; Yahoo Finance

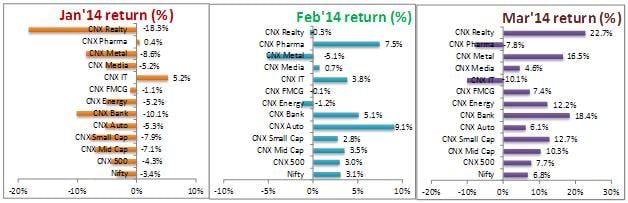

Banking stocks were the showstopper in the 1Q’14 posting maximum gain among all sectoral indices; rally came on account of RBI extension of the deadline for meeting Basel III capital norms to March 2019. The Reserve Bank of India (RBI) granted “in-principle” approval to two banking license applicants viz., IDFC and Bandhan Financial Services Private, to set up banks under the Guidelines on Licensing of New Banks in the Private Sector issued on 22 February 2013 (Guidelines). Earlier the Government raised more than US$900mn by selling a 9% stake in Axis Bank. The Government allowed more banks to import gold in what appeared to be the start of easing of import curbs; Titan Industries gained following the Government’s announcement.

Oil & Gas shares such as Reliance Industries, ONGC, Oil India, etc came into spotlight after the Election Commission sought deferment of the gas price hike. RIL shares fell while gas distributors gained on the potential delay in gas price hike.

Separately, SEBI ordered Financial Technologies to sell its stake in MCX-SX stock exchange and four other entities; SEBI ruled that the Jignesh Shah led FT is ‘not fit and proper’ to hold stake in any stock exchange.

Chart 2: Jan’14, Feb’14 and Mar’14 performance

Source: NSE

Source: NSE

Across the pond, the Federal Reserve Chairman Janet Yellen said that the QE stimulus would most likely be finished by the fall and that a rate hike could come as soon as early as mid-2015. Earlier the Fed said that it will continue trimming, or tapering, its monthly bond buying program by another US$10bn, to US$55bn a month. The Fed also said in its statement that it was dropping its 6.5% unemployment threshold for hiking interest rates, instead saying that it will strive for maximum employment and 2% inflation before any rate change.

Meanwhile, overwhelming majority of Crimeans voted to break away from Ukraine. The referendum was deemed illegal by the EU and the US, which imposed a series of sanctions on Russia. Crimea’s parliament passed a vote to proclaim the region an independent state and formally seek Russia’s permission to rejoin the country as a republic. Russia annexed Crimea, raising the prospect of more punitive measures from the West but President Vladimir Putin said he does not want to partition Ukraine.

Returning to domestic market, third quarter result season is set to start soon. A weak and stable INR along with lower commodity and agriculture prices appear to have helped corporate profitability. EBITDA margin is expected to improve whereas top-line growth is expected to remain more or less stable. As regards sectors, export-oriented sectors (IT, pharma) are expected to register robust set of numbers, while domestic investment related sectors such as cement, construction, capital goods, etc and consumption related sectors such as staples and autos are expected to post sluggish numbers. However, 2014 is still appears to be a year of fragile recovery for Indian economy.

The key point to ask now is whether market euphoria seen recently is justified given fragile economic recovery. Expectations from the general elections are swaying valuations in the Indian equity markets. Since earnings are still in a soft recovery mode, a stable political outcome can speed up recovery, whereas a hung parliament can delay the process. Equity market may remain volatile till election result is out and hence investors should be cautious investing in high beta names.

Open Lowest Brokerage

Trading Account Now

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]